For example, they will quote a three-, five- or seven-year term on a 15-, 20- or 25-year amortization (or “am”). Often times, banks will commit to a term much shorter than the amortization period. The amortization period is how long it would take to pay your loan balance down to zero (with principal and interest payments) if there were no term or call of the note. The term is how long the loan will last before the bank re-sets the interest rate or requires the outstanding balance to be paid. Term should not be confused with amortization period, though they are sometimes the same. Some banks talk about the “term” of your loan. Need more options including the ability to solve for other unknowns, change payment / compounding frequency and the ability to print an amortization schedule? Please visit, The term (duration) of the loan is expressed as a number of months. If the user enters points, this calculator includes their value in the summary and as part of the total payment at loan origination on the payment schedule. Points are expressed in percent and are calculated on the amount borrowed. Borrowers (normally only in USA) may select to pay a lender "points" up front in exchange for a lower interest rate. Points are charges that are normally due at closing. One such case might be apprciation of the real estate.) (There may be other conditions as well under which the lender will no longer require PMI. The calculator handles this automatically. The borrower can drop the insurance coverage once the mortgage balance is less than 80% of the original purchase price. Premiums are typically 0.5% to 2.0% of the original loan amount. If a borrower does not have cash to cover at least 20% of the purchase price, some lenders will require the borrower to purchase private mortgage insurance (PMI) to cover against a possible default. Property taxes and insurance are combined under escrow. If you enter values, the periodic portion of each will be calculated and shown on the schedule. Points, Annual Property Taxes, Annual Insurance and Private Mortgage Ins. Or if you know the price of the real estate and the loan amout and enter "0" for the down payment percentage, the calculator will calculate the down payment amount and percentage. If you know the mortgage amount you can afford and the cash down payment percentage required, you can calculate the affordable real estate price.

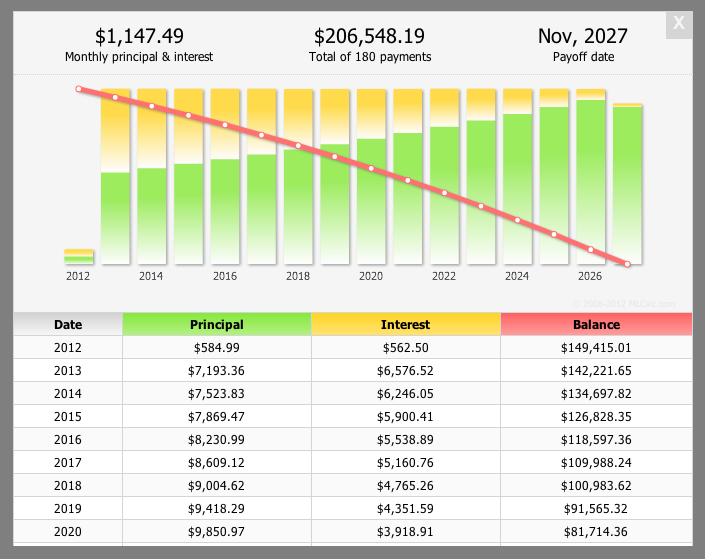

You can calculate the mortgage loan amount from the price of the real estate by providing the down payment percentage. The more you borrow, the more risk you take on, and you should carefully consider your down payment and your monthly payments, being sure not to over-obligate yourself. For example, if you borrow $400,000 on a $500,000 property, your LTV is 80%. Some lenders talk about Loan-to-Value (or LTV), which simply means how much you borrow as a percent of the purchase price. The mortgage calculator below allows you to plug in the interest rate, the present value (or principal amount), and the amortization period (or length of time to pay off your loan) in order to solve for your monthly payments.

No worries! To assist you, here are a few pointers on financing, and a mortgage calculator to aide in calculating your payments and also provide a few pointers on financing to help you along the way. You have just signed the contract, and now you realize you have another big decision: how much do you borrow, and how much will your payments be? With your advisor’s help, you have selected from three choices and you have negotiated a great deal on price and terms. You’ve hired a real estate advisor to help you find the best property. So, you’ve decided you want to purchase a building for your business.

0 kommentar(er)

0 kommentar(er)